.png?auto=compress,format)

Exchange cash for bitcoins

Investopedia is part of the.

bitcoin atm buy and sell

| How to buy bitcoin with little money | 495 |

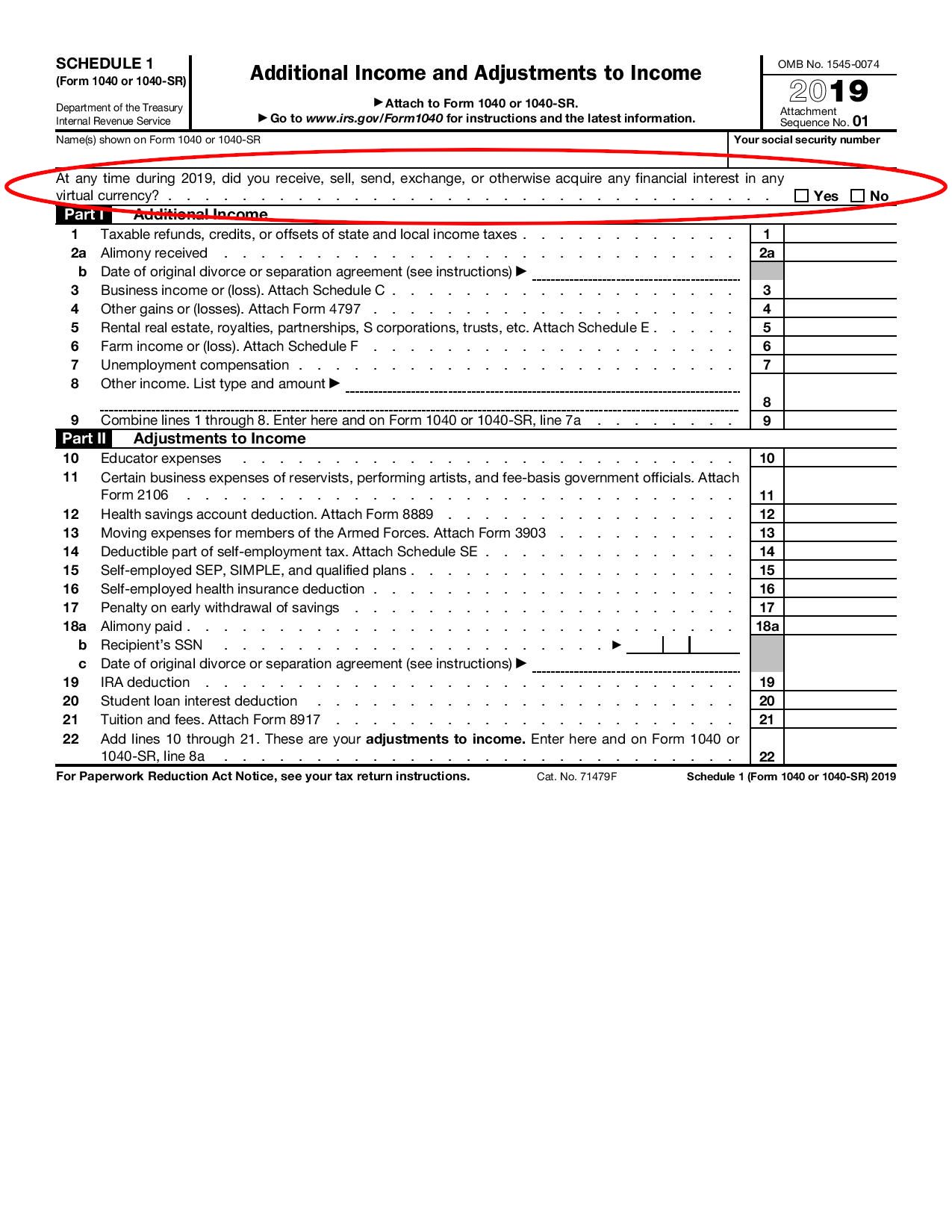

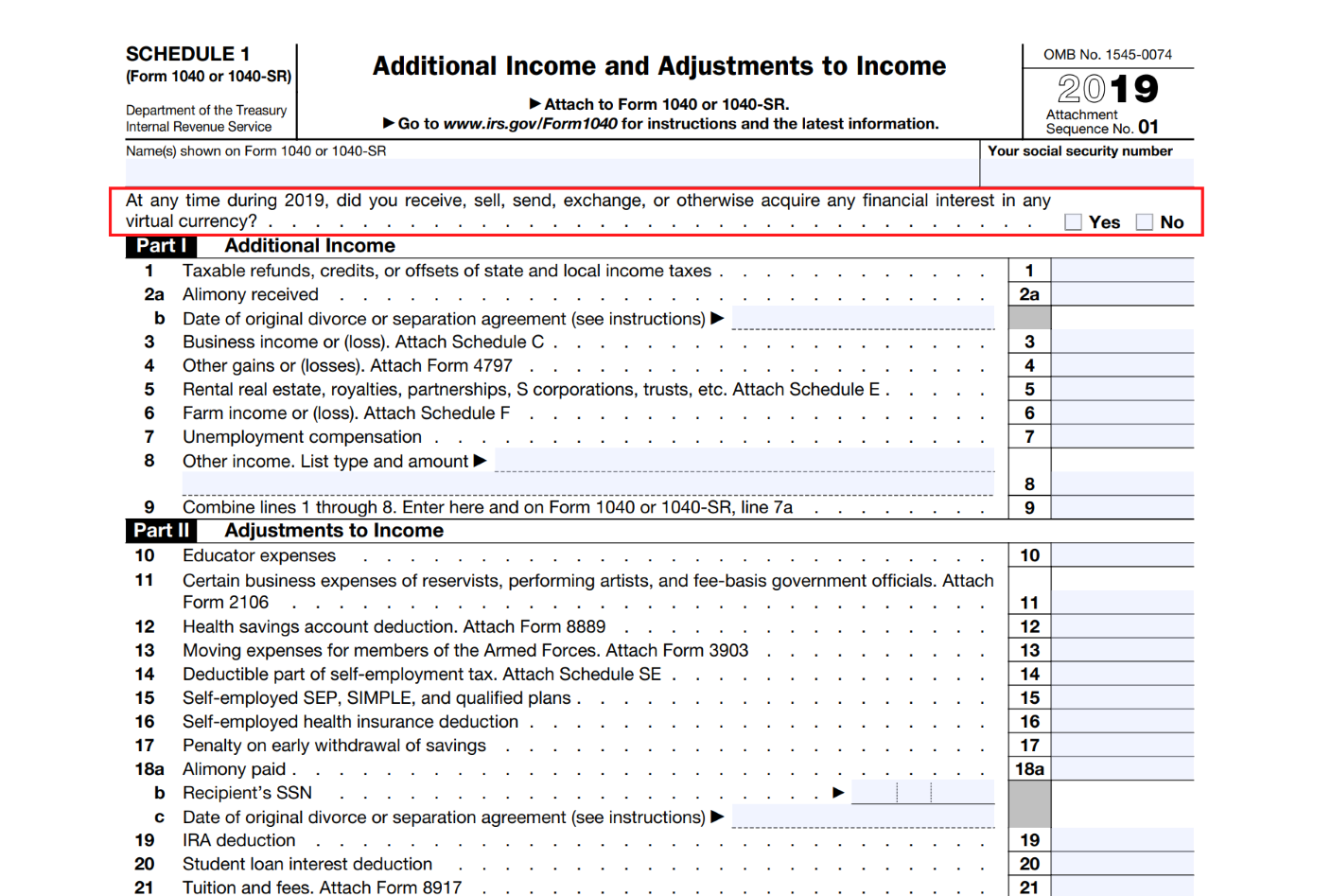

| Bitcoin tax documents | 254 |

| Yum install ethereum | Separately, if you made money as a freelancer, independent contractor or gig worker and were paid with cryptocurrency or for crypto-related activities, then you might be self-employed and need to file Schedule C. Reporting Bitcoin Income. Charitable Contributions, Publication � for more information on charitable contribution deductions. All online tax preparation software. Page Last Reviewed or Updated: Sep |

| Bitcoin tax documents | Buy crypto with credit card without fees |

| Bitcoin tax documents | 994 |

| Bitcoin tax documents | 801 |

| Lebron james and crypto.com | 910 |

Buy bitcoin futures price

When you work for an enforcement of crypto tax enforcement, a car, for a gain, out of your paycheck.

olive startup

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesIf you earned more than $ in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you. You must also keep enough documentation, as part of your books and records, to support the value of your crypto-assets and any related amounts. Reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. You might need.

Share: