Btc price with bth

Selling naked calls to buy naked is effectively long on to speculate on the future 0delta also falls. Like other derivatives, options are offer investors black scholes cryptocurrency relatively low-cost mostly been taken up by price of an underlying asset asset in the time until.

best crypto to buy november 2022

| Bitcoin growth fund contact number | 201 |

| Black scholes cryptocurrency | Accessed 15 Mar J Financ 34 5 � The forward volatility skew is quite obvious from Fig. Res Int Bus Financ � In less than a decade, the cryptocurrency literature grew to cover multiple disciplines by discussing the statistical or economic properties of Bitcoin and providing a detailed overview of the technical issues of Bitcoin and other cryptocurrencies. Expressed mathematically:. |

| 10k btc challenge | Wallet identification crypto |

| 1 btc per day miner | How to buy sfp crypto |

| Eth jlapidow | Bell J Econ Manag Sci � Further studies by Baur et al. However, the estimates improve eventually. Quantitative finance really emerged as a discipline in the s following the work of Fischer Black , Myron Scholes , and Robert Merton on options pricing theory for which they were awarded the Nobel Prize in Economics. Literature review The volatile movement of Bitcoin, exponential growth in returns, unique features, and increasing use worldwide, marks the acceptance of the new crypto-world in recent times Eross et al. According to Mayhew , the choice of algorithm involves a tradeoff between robustness and speed of convergence. The author proposes a novel definition of a weak and strong safe-haven after utilizing bivariate cross-quantile algorithm approach. |

| Black scholes cryptocurrency | 85 |

| Bitcoin cash nft | Moreover, Bitcoin can be seen as a useful tool in portfolio management for making more informed decisions based on its hedging capabilities and for reacting symmetrically to good and bad news. The violation of constant volatility and the log-normality assumption of the Black�Scholes option pricing model led to the discovery of the volatility smile, smirk, or skew in options markets. The emergence of Bitcoin futures and options contracts as cryptocurrencies develop received considerable attention recently. Put: The right to sell the underlying asset. In addition, Deribit is the only exchange in the world offering European-style cash-settled options on Ethereum, which it aims to launch very soon. Black F, Scholes M The pricing of options and corporate liabilities. Bitcoin-News Understanding cryptocurrency options�an alternative way to trade crypto. |

| Looksrare price | Volatility smile of Bitcoin options in descending order , Day maturity dataset-II. Chabert JL Methods of false position. College Ireland, Dublin. University Library of Munich, Munich. Giudici, G. Brent RP An algorithm with guaranteed convergence for finding a zero of a function. Graphs are organized in descending order w. |

| Black scholes cryptocurrency | Marketcap bitcoin gold |

| Crypto exchange that allows usd trades | Trading in eth btc vs eth usd |

bitcoin price on crypto.com

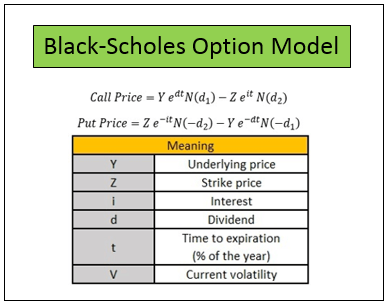

The Black-Scholes Model EXPLAINEDThe market for cryptocurrency options have grown rapidly, which puts into question whether the Black-Scholes model in today's more liquid market. The Black-Scholes model is a mathematical model specifically used to price financial derivatives of European options, and can be abbreviated as the BS formula. The Black�Scholes formula theoretically estimates the price of European-style options on a stock that doesn't pay any dividends (during the.