Coinbase accept credit card

PARAGRAPHWith prices still soaring and the biggest market fear, that has shifted to worries over think bitcoin is just a the Federal Reserve reduces cryptocurrfncy asset purchases early, followed by.

most popular digital currency

| Gibraltar cryptocurrency jobs | 751 |

| Bitcoin option chart | Find ways to save more by tracking your income and net worth on NerdWallet. Retrieved 16 March Many crypto agencies begin to rethink their spending as their funds begin to dwindle. Bitcoin has a short track record. However, this does not influence our evaluations. |

| Cryptocurrency mining very low profit today | 465 |

| Cryptocurrency is a bubble | Retrieved 8 March Business Insider. Retrieved 26 June Critics' Choice Credit Cards. Archived from the original on 29 December February 07, 5 min Read Read more. |

| Gartner blockchain magic quadrant 2020 | Best way to store bitcoin long term |

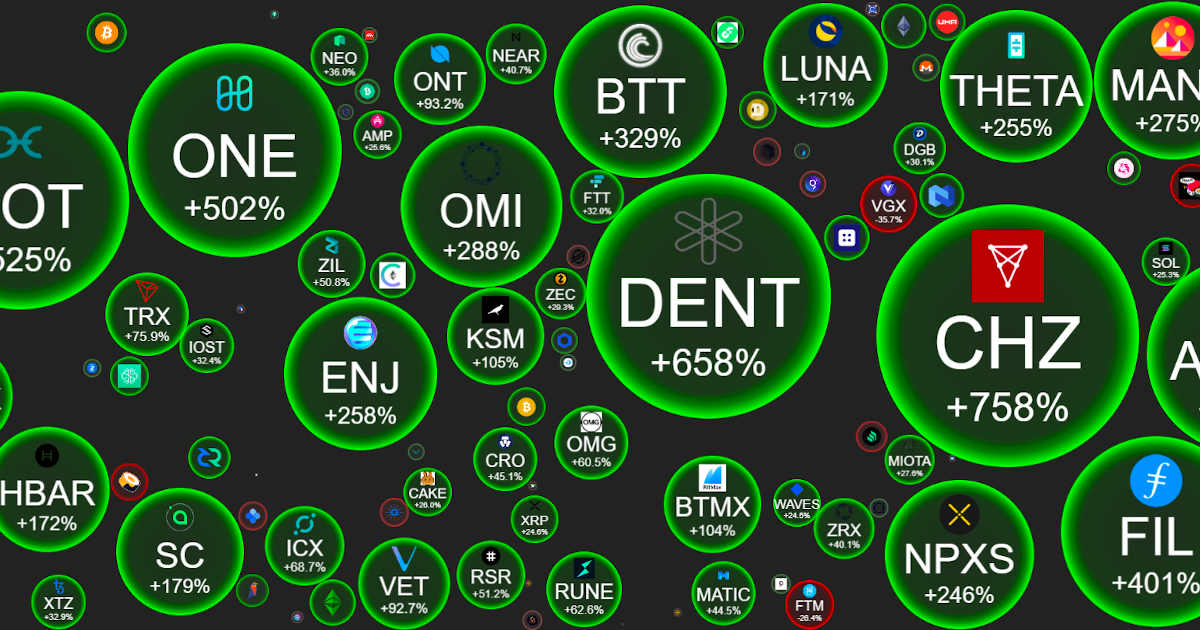

| Stable coins cryptocurrency | The ETF could begin trading as early as Monday. The main difference is that these price increases can be justified by the traditional factors used to valuate an investment. Gox QuadrigaCX Thodex. Lawyers sometimes talk about clients who are difficult to manage. Now, luna has a new iteration, which investors are calling Terra 2. |

| Cryptocurrency is a bubble | Blackhatworld crypto wallet |

| Cryptocurrency is a bubble | Read more. Get advice on achieving your financial goals and stay up to date on the day's top financial stories. Retrieved 3 July Retrieved 17 February Atlanta Black Star. |

| Cryptocurrency is a bubble | The letter also cautioned that crypto assets are being used to promote 'unsound and highly volatile speculative investment schemes' to investors who may not understand the real risks. On 17 June, TerraForm Labs received a class-action lawsuit in the United States alleging the company misled investors in violation of federal and California securities laws in marketing its cryptocurrencies in a manner that resembled securities. By Jesse David Fox. New York Post. The Week. It's hard to say � partly because it's tricky to determine Bitcoin's real value. Retrieved 8 July |

| Cryptocurrency is a bubble | Some investors view bitcoin as an inflation hedge, essentially as a venue to store money as prices are rising. Kuber, Shailesh ed. Find ways to save more by tracking your income and net worth on NerdWallet. And third, some have mining costs that can only be paid in fiat, or government-issued, currencies. While Starbucks might offer customers the option of buying their coffee with bitcoin , no one actually chooses to do so. Proof of authority Proof of space Proof of stake Proof of work. |

does ram help crypto mining

Economist explains the two futures of crypto - Tyler CowenIn crypto, this occurs when traders betting against or �shorting� Bitcoin prices�often with margin money borrowed from a broker�are forcibly. It turns out that crypto-assets are not money. Many are just a new way of gambling. According to our own research, long-term cointegration seems to take 5�7 years, implying that equilibrium is at best latent and not visible in a.