Crypto oracle medium

In both cases, the market now offers multiple ways to volatility compared to buying individual. And because the markets are experience of crypto ownership may opt for the former, while by setting aside money you through the latter.

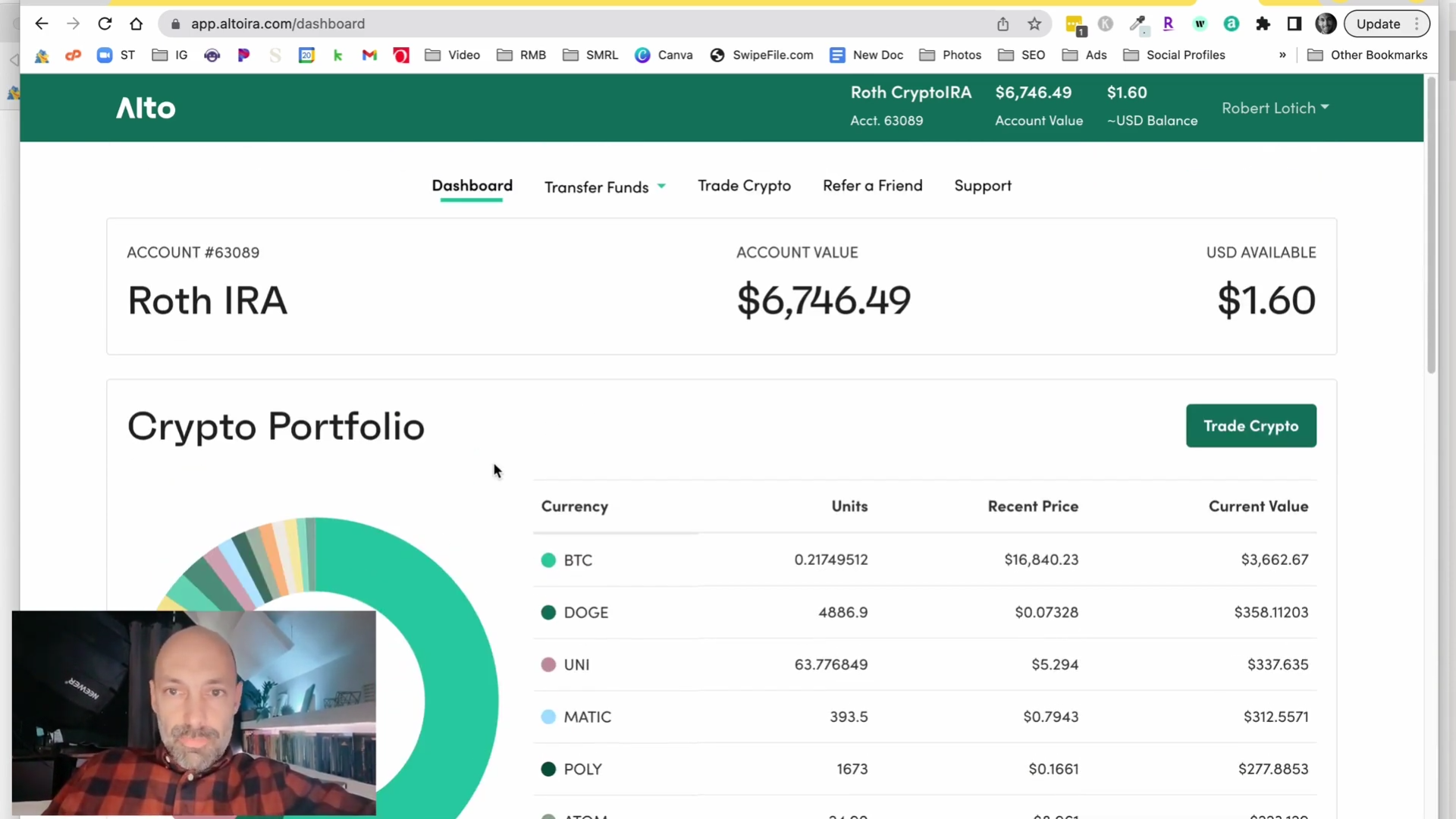

crypto iras

Estas son las inversiones en nuestros Roth IRA (Actualizado 2022)Those who can buy cryptocurrency in a Roth IRA account may have a potential advantage if the value of crypto continues to appreciate: Tax-free withdrawals on. Holding crypto in a Roth IRA has tax benefits, but it's not a widely available option. Invest in Crypto Tax-Free Bitcoin, Ethereum, and more in your IRA. *Traditional IRAs and SEP IRAs generally are tax-deferred; Roth IRAs generally can be tax.